Terms of Service

Background

By opening an account with Corebank (Powered by Corestep MFB), you are agreeing to abide by the terms and conditions outlined herein. In addition, you confirm that the information provided to us in order to create your account is accurate and complete, and that all required documentation, photographs, and other information have been submitted to us for compliance with regulatory requirements.

If you do not accept the terms and conditions outlined in this document, please discontinue use of the application immediately. It is also important to note that our relationship with you may be terminated if it is determined that you have violated any of these terms.

About Us

Corebank is a fintech platform of Corestep Microfinance Bank, and which by its nature is an electronic banking system that allows you make banking transactions in a digitized version. It’s duly licensed by the Central Bank of Nigeria (CBN)

Relationship Objective

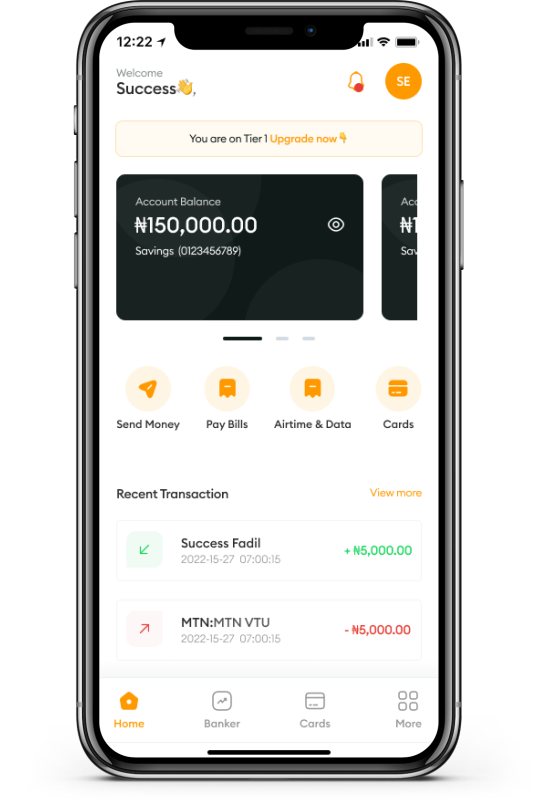

By establishing a relationship with Corebank, you will have access to special services and perks. We will take care of your bank account and also offer other helpful services like banking, savings, and credit options.

You can easily manage your account through our convenient Corebank Mobile app. To open an account, you will need a smartphone with a working phone number.

When Do These Terms Apply?

These terms apply when you decide to open an account with Corebank and we create an account number for you or you choose your own account number

Please note that we reserve the right to change these terms and conditions at any time, but we will always inform you of any changes. You can find the updated terms on our website and app, and you can access the latest version at any time.

By accessing or using CoreBank's online banking services ("Services"), you agree to the terms and conditions ("Terms").

Eligibility

By using Corebank, you agree that you are legally able to enter into this agreement and have not been banned from using Corebank in the past. You also confirm that you have the authority and ability to comply with all the terms and conditions of this agreement.

You agree not to provide false, inaccurate, or misleading information, with the intent to impersonate any person or organization, or to falsely claim or misrepresent your identity, age, or association with any person or organization.

By using Corebank, you confirm that you have followed all the terms and agreements with any third parties (such as mobile phone providers, banks, etc.) related to using digital banking.

Account Registration

To use this service, you will need to create an account by providing your name, date of birth, address, and a valid mobile number recognized by any telecommunications company in Nigeria. You may also be required to provide additional information as needed during the registration process. You must ensure that the information you provide is accurate and complete and must keep your information up-to-date.

Neither we nor anyone working with us will contact you to ask for your PIN or any other security information needed to use Corebank. If you receive any such requests, you should report them to us immediately.

Transaction

We are neither responsible nor liable for, the products or services that are paid for with the Service. Such product shall include but not be limited to

Funding your account through cards

Funding your account through cash deposit at selected partner banks

Airtime recharge

Data Top-up

Bills Payment

Funds transfer to an account

During registration, you will be required to set a PIN which must be kept private by you. The PIN is mandatory for the use of this service and you must enter and validate it before initiating any transaction.

Your account will have certain transaction limits and daily limits for using the service, set by us.

However, you can contact our customer support and meet any necessary requirements to increase or decrease these limits, depending on the restrictions on your account.

Your account will be credited when you add funds via your debit card, cash deposit or when funds is transferred to your Account from a third party.

We reserve the right to remove any of the services listed above from Corebank and do not guarantee that the services will always be available. In addition, we may add new services at any time without informing you.

Notification

When you open an account with us, you give us permission to send you text messages (SMS), emails, and push notifications. We will not be held liable if someone else sees these notifications and you suffer any loss or damage as a result.

You also agree to receive notifications from us instead of the mandatory SMS alerts set by the Central Bank of Nigeria. If any losses, damages, claims, or expenses happen as a result of these notifications, you agree to take responsibility for them.

Security and unauthorized use

You are responsible for maintaining the confidentiality of your login credentials and for all activities that occur under your account. You agree to immediately notify CoreBank of any unauthorized use of your account.

Use appropriate security on your device

Never give anyone else your security details. If you suspect that someone knows them, change them immediately and if necessary notify us to suspend or block your account and we shall endeavor to block it as soon as reasonably possibly.

You however agree that you shall be responsible for all transanctions that may be carried out on your Account prior to your Account being blocked, and we shall not be responsible for any loss(es) that occur(s) as a result of Login Details being stolen or compromised or for any losses which occur prior to the Account being blocked as requested

KYC Requirement

By agreeing to open an account with Corebank, you consent to the bank requesting additional information or documents from you, as well as access to your business area at any time. If you are unable to provide the requested information or documents required, or refuse to grant access, Corebank reserves the right to deactivate your account at its discretion. In additon, Corebank maintains the authority to suspend or deactivate your account if you provide inaccurate, incomplete, or false information as required by this agreement.

Bank Verification Number (BVN) Operations and Watch-List for the Nigerian Banking Industry

By agreeing to open an account with Corebank, you consent to the bank implementing restrictions on your account and reporting any fraudulent activity associated with the account to law enforcement agencies such as the Economic and Financial Crimes Commission, the Nigerian Financial Intelligence Unit, and the Nigerian Police Force. In addition, you consent to Corebank reporting any fraudulent activity to the Nigeria Inter-Bank Settlement Systems Plc (NIBBS) for inclusion in the Watchlist Database of the Nigerian Banking Industry and the Central Bank of Nigeria (CBN).

Disclaimer of Warranties; Limitation of Liability.

CoreBank and any third party content provider or their agents do not guarantee that the service will be without interruption or errors. They also do not make any guarantees about the results of using the service or the content. The service and content are provided "as is" and without any warranties of any kind, either express or implied. Neither CoreBank nor any third party content providers guarantee that files available for download through the service will be free from viruses or harmful features. The user assumes all risk for the quality and performance of the service and the accuracy or completeness of the content.

CoreBank, third party content providers, and their agents will not be held liable for any damages resulting from the use or inability to use the service.

Declaration

By continuing, you acknowledge that you are opening an account with Corebank using the information provided and agree to abide by the bank's terms and conditions. You also attest that the information given is accurate. By opening an account, you authorize Corebank to perform regular identity and anti-fraud verification. In addition, you agree to compensate the bank for any losses resulting from incorrect or false information provided.